Fixed Deposits

Home » Fixed Deposits

Fixed Deposit Overview

Looking for a secure way to grow your savings? With Sai Venkateswara Multipurpose Mutual Aided Co-operative Society Ltd Fixed Deposit, your money is in safe hands, ensuring a stable and prosperous financial future. Check our interest rates today and start investing with confidence.

Eligibility

Anyone who is eligible to open a Current or Savings Bank Account with the Bank are eligible to invest in term deposits.

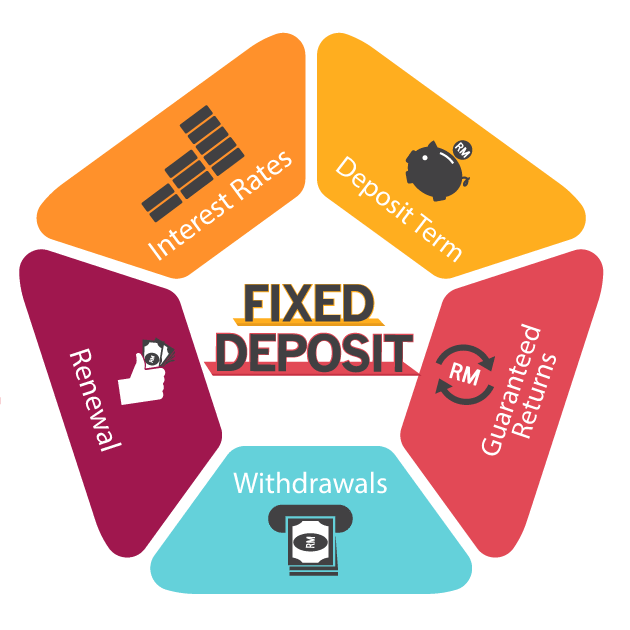

Features & Benefits

Automatic renewal facility for equal period except for special schemes

Additional 0.6% interest for Senior citizens

Overdraft/ loan against FD available

Nomination/pre-closure facilities available

- A time deposit for a fixed period to earn interest with easy liquidity.

- Interest payout - Yearly/Half yearly/quarterly/monthly basis.

- Amount - Minimum of Rs. 100/- and in multiples of 100 thereafter.

- Term - Minimum of 7 days and Maximum of 10 years

Automatic renewal facility for equal period except for special schemes

Additional 0.6% interest for Senior citizens

Overdraft/ loan against FD available

Nomination/ pre-closure facilities available

- A time deposit for a fixed period to earn interest with easy liquidity.

- Interest payout - Yearly/Half yearly/quarterly/monthly basis.

- Amount - Minimum of Rs. 100/- and in multiples of 100 thereafter.

- Term - Minimum of 7 days and Maximum of 10 years

Documents Required

List Of Valid KYC Documents For Account Opening:

- Aadhaar Card, PAN Card, Driving License, Gas Bill, Electricity Bill.

- Residential address proof.

Term Deposit Interest Rates

At Sai Venkateswara Multipurpose Mutual Aided Co-operative Society Ltd, we understand the importance of stable and secure investments. Our Fixed Deposit Scheme offers you a reliable avenue to grow your savings consistently. Here are the key features.

| S.No | Time Limit | Ordinary Members | Senior Citizen Members | ||

|---|---|---|---|---|---|

| 1 | 1 year to below 2 years | 11.50% | 949/- | 12% | 990/- |

| 2 | 2year to below 3 years | 12.50% | 1031/- | 13% | 1072/- |

| 3 | 3 year to below 5 years | 13.50% | 1112/- | 14% | 1153/- |

| 4 | 5 years | 15% | 1235/- | 15% | 1235/- |

Investment

Flexible Tenure

Seamless Transfers

Seamless Transfers

| S.No | Time Limit | Ordinary Members | Senior Citizen Members | ||

|---|---|---|---|---|---|

| 1 | 1 year to below 2 years | 11.50% | 949/- | 12% | 990/- |

| 2 | year to below 3 years | 12.50% | 1031/- | 13% | 1072/- |

| 3 | 3 year to below 4 years | 13.50% | 1112/- | 14% | 1153/- |

| 4 | 5 years | 15% | 1235/- | 15% | 1235/- |